Nearly everywhere you turn, from friends and colleagues to news channels, you can find someone with a strong opinion about the financial markets.

At the moment, it seems that the news on so many fronts is bad with skyrocketing energy costs and both equity and bond markets down significantly since the start of the calendar year.

While investing in the stock market is typically a prudent choice for investors seeking long-term growth, sharp drops can still be hard to stomach.

Below are some things to keep in mind if a market tumble makes you feel the need to “do something” which might shut you out of the strong recoveries that have historically followed market downturns.

𝐃𝐨𝐰𝐧𝐭𝐮𝐫𝐧𝐬 𝐚𝐫𝐞𝐧’𝐭 𝐫𝐚𝐫𝐞 𝐞𝐯𝐞𝐧𝐭𝐬

Typical investors, in all markets, will endure many of them during their lifetime. There has been a lot of focus on the transition to a bear market (with the line in the sand of a 20% decline having been triggered by the US S&P 500 index in mid-June 2022).

This is the same market that delivered returns of 36% for the year ended December 2021, and even with a 20% decline at the onset of the Covid pandemic, recorded 7.3% for the year ended December 2020.

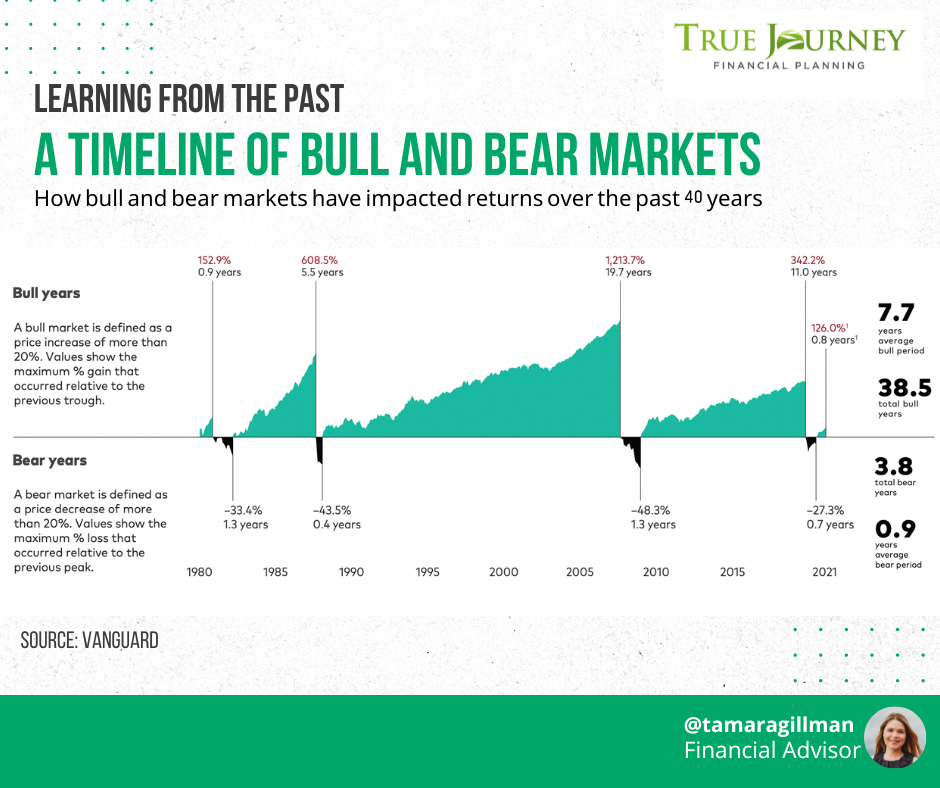

It is important to keep in context that in spite of several bear markets, the market has also continued to trend higher over the long term. Not all financial market declines are the same in length or severity.

For example, historically speaking, the GFC of 2008-2009 was an extreme anomaly. As challenging as that event was, it was followed by one of the longest stock market recoveries in history.

The Australian equity market (which admittedly recorded a more modest, but still very respectable 17.5% for the year ended December 2021), has held up relatively well, posting a decline of 11% (so not yet in the bear territory).

𝐃𝐫𝐚𝐦𝐚𝐭𝐢𝐜 𝐦𝐚𝐫𝐤𝐞𝐭 𝐥𝐨𝐬𝐬𝐞𝐬 𝐜𝐚𝐧 𝐬𝐭𝐢𝐧𝐠, 𝐛𝐮𝐭 𝐢𝐭’𝐬 𝐢𝐦𝐩𝐨𝐫𝐭𝐚𝐧𝐭 𝐭𝐨 𝐤𝐞𝐞𝐩 𝐚 𝐥𝐨𝐧𝐠-𝐭𝐞𝐫𝐦 𝐩𝐞𝐫𝐬𝐩𝐞𝐜𝐭𝐢𝐯𝐞 𝐚𝐧𝐝 𝐬𝐭𝐚𝐲 𝐢𝐧𝐯𝐞𝐬𝐭𝐞𝐝 𝐢𝐧 𝐨𝐫𝐝𝐞𝐫 𝐭𝐨 𝐩𝐚𝐫𝐭𝐢𝐜𝐢𝐩𝐚𝐭𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐫𝐞𝐜𝐨𝐯𝐞𝐫𝐢𝐞𝐬 𝐭𝐡𝐚𝐭 𝐭𝐲𝐩𝐢𝐜𝐚𝐥𝐥𝐲 𝐟𝐨𝐥𝐥𝐨𝐰.

Some bear markets since 1980 have been sharp, but many bull market surges have been even more dramatic, and often longer, leaving stock investors well compensated over the long term for the risk they took on.

But such action would shut you out of the strong recoveries that have historically followed market downturns. The answer is to come up with a game plan before the next market pullback so you’re well positioned to try to take advantage of the opportunities that follow.

What’s more, you’ll probably know what to expect as markets cycle through their phases, so you can tune out messages that don’t help your strategy.

𝐅𝐢𝐧𝐚𝐥 𝐬𝐚𝐲

Please don’t hesitate to contact me should you have any questions, require assistance, or wish to discuss any of the above in more detail. Book in a call

𝘕𝘰𝘵𝘦𝘴: 1 𝘛𝘩𝘦 𝘭𝘢𝘵𝘦𝘴𝘵 𝘣𝘶𝘭𝘭 𝘳𝘶𝘯 𝘪𝘴 𝘴𝘵𝘪𝘭𝘭 𝘰𝘯𝘨𝘰𝘪𝘯𝘨. 𝘛𝘩𝘦𝘤 𝘢𝘭𝘤𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘳𝘦𝘱𝘳𝘦𝘴𝘦𝘯𝘵 𝘵𝘩𝘦 𝘱𝘳𝘪𝘤𝘦 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦 𝘢𝘯𝘥 𝘱𝘦𝘳𝘪𝘰𝘥 𝘶𝘱𝘵𝘰 30 𝘑𝘶𝘯𝘦 2021. 𝘊𝘢𝘭𝘤𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘢𝘳𝘦 𝘣𝘢𝘴𝘦𝘥 𝘰𝘯 𝘵𝘩𝘦 𝘚&𝘗 𝘈𝘭𝘭 𝘖𝘳𝘥𝘪𝘯𝘢𝘳𝘪𝘦𝘴 𝘐𝘯𝘥𝘦𝘹 𝘧𝘰𝘳 𝘵𝘩𝘦 𝘱𝘦𝘳𝘪𝘰𝘥 1/1/1980 𝘵𝘰 30/6/2021. 𝘈 𝘣𝘦𝘢𝘳 𝘮𝘢𝘳𝘬𝘦𝘵 𝘪𝘴 𝘥𝘦𝘧𝘪𝘯𝘦𝘥 𝘢𝘴 𝘢 𝘱𝘳𝘪𝘤𝘦 𝘥𝘦𝘤𝘳𝘦𝘢𝘴𝘦 𝘰𝘧 𝘮𝘰𝘳𝘦 𝘵𝘩𝘢𝘯 20%. 𝘈 𝘣𝘶𝘭𝘭 𝘮𝘢𝘳𝘬𝘦𝘵 𝘪𝘴 𝘥𝘦𝘧𝘪𝘯𝘦𝘥 𝘢𝘴 𝘢 𝘱𝘳𝘪𝘤𝘦 𝘪𝘯𝘤𝘳𝘦𝘢𝘴𝘦 𝘰𝘧 𝘮𝘰𝘳𝘦 𝘵𝘩𝘢𝘯 20%. 𝘛𝘩𝘦 𝘱𝘭𝘰𝘵𝘵𝘦𝘥 𝘢𝘳𝘦𝘢𝘴 𝘥𝘦𝘱𝘪𝘤𝘵 𝘵𝘩𝘦 𝘭𝘰𝘴𝘴𝘦𝘴/ 𝘨𝘢𝘪𝘯𝘴 𝘳𝘢𝘯𝘨𝘪𝘯𝘨 𝘧𝘳𝘰𝘮 𝘵𝘩𝘦 𝘮𝘪𝘯𝘪𝘮𝘶𝘮 𝘧𝘰𝘭𝘭𝘰𝘸𝘪𝘯𝘨 𝘢 20% 𝘭𝘰𝘴𝘴 𝘵𝘰 𝘵𝘩𝘦 𝘳𝘦𝘴𝘱𝘦𝘤𝘵𝘪𝘷𝘦 𝘮𝘢𝘹𝘪𝘮𝘶𝘮 𝘧𝘰𝘭𝘭𝘰𝘸𝘪𝘯𝘨 𝘢 20% 𝘢𝘱𝘱𝘳𝘦𝘤𝘪𝘢𝘵𝘪𝘰𝘯 𝘪𝘯 𝘵𝘩𝘦 𝘶𝘯𝘥𝘦𝘳𝘭𝘺𝘪𝘯𝘨 𝘪𝘯𝘥𝘦𝘹. 𝘊𝘢𝘭𝘤𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘣𝘢𝘴𝘦𝘥 𝘰𝘯 𝘮𝘰𝘯𝘵𝘩𝘭𝘺 𝘥𝘢𝘵𝘢. 𝘓𝘰𝘨𝘢𝘳𝘪𝘵𝘩𝘮𝘪𝘤 𝘴𝘤𝘢𝘭𝘦𝘴 𝘢𝘳𝘦 𝘶𝘴𝘦𝘥 𝘧𝘰𝘳 𝘵𝘩𝘪𝘴 𝘪𝘭𝘭𝘶𝘴𝘵𝘳𝘢𝘵𝘪𝘰𝘯. 𝘈𝘭𝘭 𝘥𝘪𝘴𝘵𝘳𝘪𝘣𝘶𝘵𝘪𝘰𝘯𝘴 𝘢𝘳𝘦 𝘳𝘦𝘪𝘯𝘷𝘦𝘴𝘵𝘦𝘥.

𝘚𝘰𝘶𝘳𝘤𝘦: 𝘔𝘰𝘳𝘯𝘪𝘯𝘨𝘴𝘵𝘢𝘳 𝘋𝘢𝘵𝘢 𝘢𝘯𝘥 𝘝𝘢𝘯𝘨𝘶𝘢𝘳𝘥. 𝘝𝘢𝘯𝘨𝘶𝘢𝘳𝘥 𝘐𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵𝘴 𝘈𝘶𝘴𝘵𝘳𝘢𝘭𝘪𝘢 𝘓𝘵𝘥 (𝘈𝘉𝘕 72 072 881 086 / 𝘈𝘍𝘚 𝘓𝘪𝘤𝘦𝘯𝘴𝘦 227263) 𝘪𝘴 𝘵𝘩𝘦 𝘱𝘳𝘰𝘥𝘶𝘤𝘵 𝘪𝘴𝘴𝘶𝘦𝘳 𝘢𝘯𝘥 𝘵𝘩𝘦 𝘖𝘱𝘦𝘳𝘢𝘵𝘰𝘳 𝘰𝘧 𝘝𝘢𝘯𝘨𝘶𝘢𝘳𝘥 𝘗𝘦𝘳𝘴𝘰𝘯𝘢𝘭 𝘐𝘯𝘷𝘦𝘴𝘵𝘰𝘳. 𝘞𝘦 𝘩𝘢𝘷𝘦 𝘯𝘰𝘵 𝘵𝘢𝘬𝘦𝘯 𝘺𝘰𝘶𝘳 𝘤𝘪𝘳𝘤𝘶𝘮𝘴𝘵𝘢𝘯𝘤𝘦𝘴 𝘪𝘯𝘵𝘰 𝘢𝘤𝘤𝘰𝘶𝘯𝘵 𝘸𝘩𝘦𝘯 𝘱𝘳𝘦𝘱𝘢𝘳𝘪𝘯𝘨 𝘵𝘩𝘦 𝘢𝘣𝘰𝘷𝘦 𝘪𝘯𝘧𝘰𝘳𝘮𝘢𝘵𝘪𝘰𝘯 𝘴𝘰 𝘪𝘵 𝘮𝘢𝘺 𝘯𝘰𝘵 𝘣𝘦 𝘢𝘱𝘱𝘭𝘪𝘤𝘢𝘣𝘭𝘦 𝘵𝘰 𝘺𝘰𝘶𝘳 𝘤𝘪𝘳𝘤𝘶𝘮𝘴𝘵𝘢𝘯𝘤𝘦𝘴. 𝘠𝘰𝘶 𝘴𝘩𝘰𝘶𝘭𝘥 𝘤𝘰𝘯𝘴𝘪𝘥𝘦𝘳 𝘺𝘰𝘶𝘳 𝘤𝘪𝘳𝘤𝘶𝘮𝘴𝘵𝘢𝘯𝘤𝘦𝘴 𝘢𝘯𝘥 𝘰𝘶𝘳 𝘐𝘋𝘗𝘚 𝘎𝘶𝘪𝘥𝘦, 𝘗𝘳𝘰𝘥𝘶𝘤𝘵 𝘋𝘪𝘴𝘤𝘭𝘰𝘴𝘶𝘳𝘦 𝘚𝘵𝘢𝘵𝘦𝘮𝘦𝘯𝘵 (𝘗𝘋𝘚) 𝘰𝘳 𝘗𝘳𝘰𝘴𝘱𝘦𝘤𝘵𝘶𝘴 𝘣𝘦𝘧𝘰𝘳𝘦 𝘮𝘢𝘬𝘪𝘯𝘨 𝘢𝘯𝘺 𝘪𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵 𝘥𝘦𝘤𝘪𝘴𝘪𝘰𝘯. 𝘠𝘰𝘶 𝘤𝘢𝘯 𝘢𝘤𝘤𝘦𝘴𝘴 𝘰𝘶𝘳 𝘐𝘋𝘗𝘚 𝘎𝘶𝘪𝘥𝘦, 𝘗𝘋𝘚 𝘰𝘳 𝘗𝘳𝘰𝘴𝘱𝘦𝘤𝘵𝘶𝘴 𝘰𝘯𝘭𝘪𝘯𝘦 𝘢𝘵 𝘸𝘸𝘸.𝘷𝘢𝘯𝘨𝘶𝘢𝘳𝘥.𝘤𝘰𝘮.𝘢𝘶 𝘰𝘳 𝘣𝘺 𝘤𝘢𝘭𝘭𝘪𝘯𝘨 𝘶𝘴 𝘰𝘯 1300 655 101. 𝘗𝘢𝘴𝘵 𝘱𝘦𝘳𝘧𝘰𝘳𝘮𝘢𝘯𝘤𝘦 𝘪𝘴 𝘯𝘰𝘵 𝘢𝘯 𝘪𝘯𝘥𝘪𝘤𝘢𝘵𝘪𝘰𝘯 𝘰𝘧 𝘧𝘶𝘵𝘶𝘳𝘦 𝘱𝘦𝘳𝘧𝘰𝘳𝘮𝘢𝘯𝘤𝘦. 𝘛𝘩𝘪𝘴 𝘱𝘶𝘣𝘭𝘪𝘤𝘢𝘵𝘪𝘰𝘯 𝘸𝘢𝘴 𝘱𝘳𝘦𝘱𝘢𝘳𝘦𝘥 𝘪𝘯 𝘨𝘰𝘰𝘥 𝘧𝘢𝘪𝘵𝘩 𝘢𝘯𝘥 𝘸𝘦 𝘢𝘤𝘤𝘦𝘱𝘵 𝘯𝘰 𝘭𝘪𝘢𝘣𝘪𝘭𝘪𝘵𝘺 𝘧𝘰𝘳 𝘢𝘯𝘺 𝘦𝘳𝘳𝘰𝘳𝘴 𝘢𝘯𝘥 𝘰𝘮𝘪𝘴𝘴𝘪𝘰𝘯𝘴. © 2021 𝘝𝘢𝘯𝘨𝘶𝘢𝘳𝘥 𝘐𝘯𝘷𝘦𝘴𝘵𝘮𝘦𝘯𝘵𝘴 𝘈𝘶𝘴𝘵𝘳𝘢𝘭𝘪𝘢 𝘓𝘵𝘥. 𝘈𝘭𝘭 𝘳𝘪𝘨𝘩𝘵𝘴 𝘳𝘦𝘴𝘦𝘳𝘷𝘦𝘥. 𝘈𝘋𝘝𝘚𝘛𝘊𝘉𝘉𝘔𝘈_072021