Superannuation in your 30’s

If you’re in your thirties, chances are life revolves around balancing your wish list (holidays!) and your responsibilities. You may even have kids and a home loan, or planning for those.

If you’re a homeowner, you’ll know this is the period where your home loan repayments are at their highest. So why am I asking you to think about Super?

As your career takes off, your thirties can be a time to earn good money and squirrel away for future events such as maternity leave, raising a family and part-time work in the future.

Also, the sooner you start thinking about Super, and get professional advice, the sooner you’ll be able to retire! In fact, a recent study by SunSuper showed that couples who sought financial advice retired with over $200,000 more than those that didn’t.

Comfort and security

By the time a 35-year-old couple today reaches retirement age in 32 years’ time, it’s estimated they’ll need around $155,680 per year to enjoy a ‘comfortable’ retirement.

To support that level of income in 30 years’ time, you’ll need a combined nest egg of about $2.7 million!

Does this sound like you?

1) You earn over $60,000 per year

2) You’re willing to put aside some cash that will be invested for your retirement

3) You’re happy to get a tax deduction!

If this sounds like you, then consider making salary sacrifice (pre-tax) contributions to your Super. Super contributions and earnings are taxed at 15%, so your savings will grow faster in Super than anywhere else.

For example, if you’re earning $100,000 per year and you send $10,000 of this to your Superfund, you’ll save $3,900 in income tax for that year – and increase your Super balance by $8,500! This is because Super only pays tax at 15%, but at that level, you’re paying tax at 39%. Put simply, by sending some of your money to Super, you’re able to keep more of it, instead of giving it to the.

Just keep in mind to only add money that you don’t need to Super, as it’s locked away until retirement.

Consider growth assets

If you can’t afford to make extra Super contributions right now, there’s one powerful thing you can do. That is to make sure your Super is invested for strong growth. Over time, if your Super is invested with a higher proportion of shares, property and other Growth focused investments, this will perform better than a fund that has more low growth investments, such as Cash and Term Deposits. Therefore, don’t go for the default investment option that you’ve been given- instead seek advice on what’s right for you.

Remember, the higher the return, the more ‘ups’ and ‘downs’ you’ll see in your portfolio in the short term, but over the long term you’ll end up with a larger balance to generate income for you in retirement.

Let your Super pay for insurance (and protect your lifestyle now).

For any young family, financial protection is crucial. Death or disablement of either parent would be disastrous. Setting up quality insurance through your Super is easy and affordable.

Your Superfund can provide you with

- a) Life,

- b) TPD (Total Permanent Disablement) and

- c) Income Protection

Don’t just think to yourself ‘I already have this insurance in my Super. Most ‘default’ insurance is much less than what is needed. For example, do you know how long your Income Protection will continue to pay you? For 2 years or until age 65?

‘Default insurance’ is fine as a start, but it’s designed to be tailored to your needs and situation.

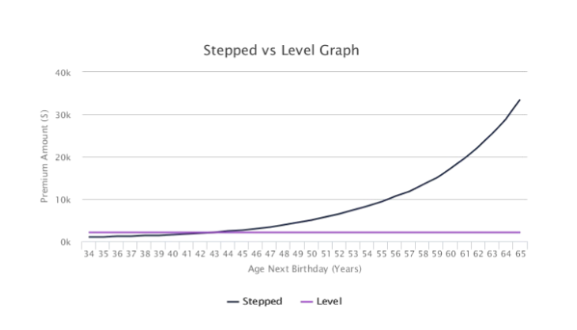

Consider ‘Level’ premiums

Level premiums is a strategy that allows you to ‘lock-in’ the cost of your cover at your current age, meaning you pay less for your premiums.

Level premiums are represented by the purple line in the graph below:

*general simulation only excludes CPI, modeled on a 34-year-old.

Whether it’s Super, insurance, establishing investments or building your career, there’s a lot to think about when you’re in your 30’s! It’s an ideal age to start some serious financial planning which will give you a huge benefit in the long run. Don’t put it off and get to your 50’s and think “I wish I had have done more earlier” – take action today.

The strategies mentioned above can be complex, so we recommend that you seek professional and personal advice from a Certified Financial Planner®.

Any advice in this publication is of a general nature only and has not been tailored to your personal circumstances. Please seek personal advice prior to acting on this information. Before making a decision to acquire a financial product, you should obtain and read the Product Disclosure Statement (PDS) relating to that product. The information in this document reflects our understanding of existing legislation, proposed legislation, rulings etc as at the date of issue. In some cases, the information has been provided to us by third parties. While it is believed the information is accurate and reliable, this is not guaranteed in any way. Opinions constitute our at the time of issue and are subject to change. Neither, the Licensee or any of its related companies, nor their employees or directors give any warranty of accuracy, nor accept any responsibility for errors or omissions in this document. True Journey Financial Planning Pty Ltd are Authorised Representatives of GWM Adviser Services Limited ABN 96 002 071 749, an Australian Financial Services Licensee, Registered office at 105 –153 Miller St North Sydney NSW 2060. Our Financial Services Guide is available in the footer of our website at www.truejourneyfinancial.com.au

Calculations:

[i] Value of $60,457 today – the income required to provide a couple with a “comfortable” level of income as calculated by The Association of Superannuation Funds of Australia (ASFA) (Sept 2017) – in 32 years at 3% inflation.

[ii] Sum required to fund an annual income of $155,680 for 30 years at a return of 4% pa after inflation, fees, and tax, disregarding any age pension.